This guide covers the submission of periodic tax returns in Netvisor. You can access the view via the path Financial Management > Company Obligations > Submission of Self-Initiated Taxes.

CONTENTS

Access rights

Access to the view requires the Payroll role (P) and at least the "Accounting" sub-section "VAT processing" Edit rights in the Accounting section's Function-specific rights.

If payroll is not used in the company or the person does not have the payroll role, access to the view is also possible if they have "Accounting" sub-section "VAT processing" Edit rights and the accountant's KP role. If you only want to view the information, then read rights are required in the VAT processing section. However, the accountant's role is needed.

Submission of the declaration

The system offers ready-to-send declarations by default. To send the VAT period declaration and/or employer performance declaration, the company must have a certificate in order. After this, select the desired declarations to be sent and press the "Send selected" button.

When the material has been successfully sent, the notification below will appear.

When sending material from Netvisor, it goes immediately to the tax authority, but there may be a delay on the tax authority's side before the declaration appears in OmaVero. According to the tax authority's instructions, the main rule is that the information appears within 2-3 business days after submission in OmaVero. Especially for quarterly reporters, there may be a delay in the declaration appearing in OmaVero, as these may not automatically target the correct tax period and require manual processing on the tax authority's side.

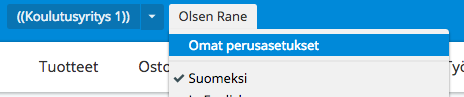

Note! When sending a declaration, a phone number is a mandatory piece of information. The number is retrieved from the sender's own basic information under My Basic Information. You can add/update the number under "My Basic Settings," which is here:

An accounting office user can send declarations for multiple client companies of the accounting office simultaneously if they first log into the accounting office environment, go to this self-initiated tax submission view, and select multiple companies from the list by holding down the CTRL key and selecting the desired companies with the mouse. All companies can be selected by first selecting the first company on the list and then holding down the SHIFT key and selecting the last company on the list.

The Cancel button in the Ready-to-send materials view removes the declaration from this submission view, and it returns to the self-initiated taxes view.

The schedule for the payment of self-initiated taxes is visible on the tax authority's side here.

Transfer file

If the submission of the control declaration is unsuccessful, it is possible to create a transfer file from the Control Declaration view for the ilmoitin.fi service. The file is created by pressing the "Process selected without sending" button and selecting "create and download ilmoitin.fi transfer file" (remember to check the box in front of the desired declaration before pressing the button). Save the transfer file to the desired folder on your hard drive and go to send it manually via the ilmoitin.fi service.

When the submission is done via the ilmoitin.fi service, you must mark the respective control declaration as sent. Check the box in front of the declaration and press the "Process selected without sending and "Mark declarations as sent" button. This button does not send any material to the tax authority, it only sets the declaration status to "sent," so it does not appear, for example, in the obligations widget on the homepage.

Archived materials

In the self-initiated tax submission view, you can also review already sent and archived declarations by selecting the material status as "Archived."

In the Archived view, you can verify the material creation date, submission date, and status.

Frequently asked questions

I have accidentally marked the periodic tax return as sent, but I need to send the declaration to the Tax Authority. How do I proceed?

Answer: If the declaration has been marked as sent and it still needs to be sent to the Tax Authority, an override of the VAT lock can be done and immediately followed by a cancellation of the override. When the declaration is then created, the system will suggest the first submission of the period.

When will the sent periodic tax return appear in OmaVero?

Answer: According to the information received from the Tax Authority, the normal processing time is 2-3 business days.

Keywords: Periodic tax return, submission of periodic tax return

Did you find it helpful? Yes No

Send feedback