Thank you for choosing e-invoicing! You are reducing your environmental impact at the same time.

Thank you for choosing e-invoicing! You are reducing your environmental impact at the same time.The guide covers the process of implementing consumer e-invoicing in Netvisor through a supported bank. The guide addresses step-by-step actions such as setting up a bank account, creating and processing billing notifications, and managing e-invoicing. The guide explains how to proceed if consumer e-invoicing has remained active in the old system and how to proceed if the company's bank changes.

CONTENT

- Service activation and starting use

- Creating a billing notification

- Sending a billing notification

- Transfer of consumer e-invoicing to Netvisor from another system

- Consumer e-invoicing transfer tool

- Consumer e-invoice billing notifications

- Processing receipt notifications

- Sending consumer e-invoices

- Canceling a consumer e-invoice

- Canceling a direct debit invoice

- Local printing

- Customer changes bank

- When the company's bank changes

- Consumer e-invoicing with auxiliary business names.

- Consumer e-invoicing, if it has remained active in the old system

Service activation and starting use

Consumer e-invoices are sent from Netvisor to customers through bank connections, they do not go through Maventa. In order to send consumer e-invoices from Netvisor, the sending of consumer e-invoices must first be agreed upon with the company's own bank through a payment traffic agreement. The agreement must be set in the bank's system to Netvisor's bank group-specific WebServices channel.

Once the agreement with the bank is in place, it must be checked that the bank account has been added to the company's bank accounts in bank account management. In addition, a check mark must be placed in the bank account information in the section "Account available on invoice forms" so that the sender's e-invoice address is formed for the billing notifications to be sent.

After this, the bank account in question is added to the Invoicing addresses page as a new e-invoice address. When adding e-invoice address information, select the correct format for the e-invoice address IBAN/OVT (this information can be found on the payment traffic agreement).

Note: If the company has a Danskebank account, the consumer e-invoice agreement must be made to an IBAN-formatted address for Danskebank.

In other words, click the company's name and select invoicing addresses from the menu.

Select the bank account from the menu, check the option "consumer e-invoice sending" and choose whether the agreement was made in IBAN or OVT format. The operator ID and intermediary are automatically retrieved from the bank account.

Creating a billing notification

When the settings are in place in Netvisor, i.e., the bank account has been added to the bank accounts and consumer e-invoice sending has been added to the desired bank account in invoicing addresses, billing notifications can be created. Billing notifications are made and sent through the "Consumer e-invoicing" function:

In the view that opens, click the link "Add new billing notification" in the upper right corner:

Access to the view requires, for example, accounts receivable user rights or broader rights. However, for basic information, you must have editing rights in the basic information management section.

Mandatory fields for the billing notification to be sent are marked with a red star:

- E-invoice address (target bank)

- Instructions for the invoice recipient (in Finnish)

- Invoice subject text (Finnish)

E-invoice address

- Select the bank account for which the payment traffic agreement for sending consumer e-invoices has been made

- The selectable bank accounts are those whose basic information has a check mark in the section "Show address on invoicing address printout". If the correct account is not found in the list, it is advisable to check the account settings

Instructions for the invoice recipient

- Add here the instruction text visible in the customer's online bank from the biller to the payer. For example, "After ordering the e-invoice, we will no longer deliver paper invoices".

Service level

- It is advisable to choose "E-Invoice and direct payment" as the service level, even if the company's customers currently do not have a need to receive direct payment invoices. If there is a need for sending direct payment invoices later, this will not be possible if direct payments have not been selected in the service level of the billing notification. Changing the service level afterwards requires sending a change notification.

Customer identification information

- Choose whether to use the previous invoice reference number or customer number for customer identification. If the customer number has leading zeros, Netvisor does not remove them.

Select banks to which the billing notification is sent

- It is advisable to select all banks on the notification, even if the company's current customers are not customers of all banks. This way, the creation of a consumer e-invoice agreement for a new bank group customer is not prevented.

Invoice subject

- It is advisable to choose a subject that describes the billing so that the customer can select the correct billing subject when making the agreement. For example, Electricity bill, Water charge, Membership fee. The same biller can have several different billing notifications with different invoice subjects. Separate billing notifications must be sent for each separate invoice subject. This is possible even if the bank account is the same.

- The Finnish subject is mandatory, but other languages are also recommended to be filled in. Language versions must be written in the respective language by yourself.

Biller's bank contact information

- Select the company's bank accounts to which customer payments are desired to be made.

Sending a billing notification

Once the billing notification information is filled in, click the button "Continue to sending page" at the bottom of the page. In the view that opens, the notification to be sent is visible:

If you notice anything that needs to be corrected on the billing notification to be sent, you can return to the previous page to edit the notification by clicking the button "Return to the previous page". If all the information on the notification is correct, send the billing notification forward by clicking the button "Send e-invoice billing notification to the bank". A successful send gives the confirmation notification below:

Once the material has been sent to the bank, this company should be found in the bank within a couple of days, and then individual customers can receive e-invoices from this company. We recommend logging into the bank with your personal banking credentials and then you can check if the company is found on the bank's side among the companies from which consumer e-invoices can be received. At the same time, we recommend checking that the company is not found multiple times, and if it is, then bring the selection to Netvisor where the invoice subject text matches what it is in Netvisor. We would then recommend sending a removal notification from the other system where there is a different invoice subject text. If a customer chooses it, then the authorization does not come to Netvisor but goes to the other program. If a removal notification is sent from the other system, it only removes that billing notification.

Transfer of consumer e-invoicing to Netvisor from another system

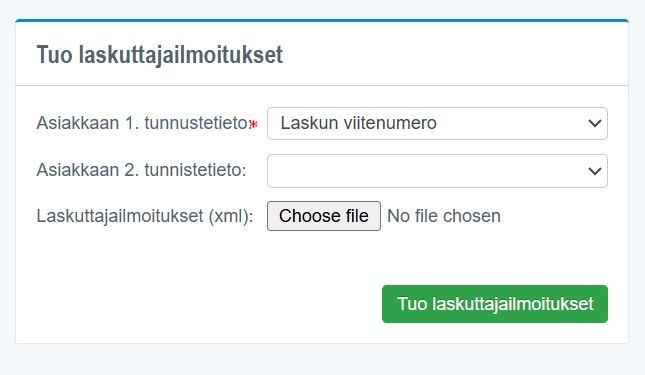

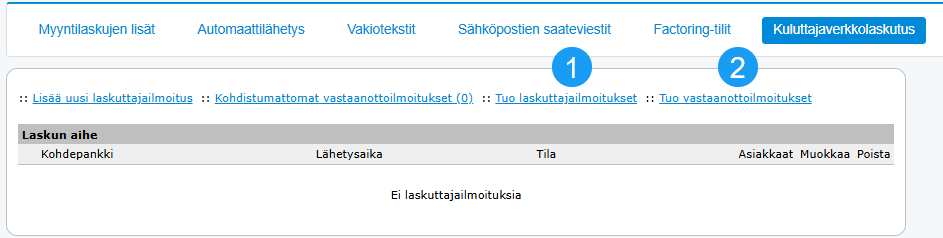

If the company has sent consumer e-invoices from another system and wants to transfer the billing notifications valid in the banks, as well as the company's customers' receipt notifications, to Netvisor, this can be done with a transfer tool found in Sales > Consumer e-invoicing > Import billing notifications (1) /Import receipt notifications (2)

NOTE! It is good to allocate time for the transfer of consumer e-invoicing and be aware that there may be a billing break during the transfer if Change messages need to be made in the old system before the transfer.

Before transferring billing and receipt notifications, the customer must ensure the following:

- The company is established in Netvisor

- Customers are established in Netvisor, and customer cards have customer numbers. Receipt notifications are allocated in Netvisor based on the customer number, so if the customer numbers in Netvisor match the customer numbers in the receipt notifications, the receipt notifications will automatically be allocated to the customer cards after the transfer. This means that the customer numbers in Netvisor must match those in the old system.

- The company's bank accounts have been added to the bank accounts to which consumer e-invoicing is linked. The payment traffic agreement with the bank must also have agreed on the sending of consumer e-invoices through Netvisor. NOTE! The account must be the same as the one selected as the biller's e-invoice address for the billing notifications to be transferred.

- The biller's e-invoice address must be found in the Invoicing addresses view, and the correct format IBAN / OVT must be selected for the address according to how it is on the billing notifications. The purpose of use for the e-invoice address is selected as “Consumer e-invoice sending”

- All the company's bank accounts to which payment transactions are desired must be established in Netvisor

- The material to be transferred must be in XML or CSV format. The materials can be either as individual files or all in one file, however, so that billing notifications are in their own and receipt notifications in their own.

- The tool also allows you to take a CSV template file, into which you can enter the information manually if necessary.

Other important considerations before transfer:

- If the company's bank is Danske Bank, and the agreement for sending consumer e-invoices has been made in the bank to the biller's OVT-formatted e-invoice address, the address must first be changed on the bank's payment traffic agreement to an IBAN-formatted e-invoice address. After this, change messages must be sent from the old system to all banks, where the biller's e-invoice address is changed to an IBAN-formatted e-invoice address. When the change messages have been sent to the banks, they can be transferred to Netvisor a few banking days after sending the change messages

- If the company's consumer e-invoices are sent through an intermediary bank in the current program (different from the customer's own bank where consumer e-invoicing is valid), change messages must be sent from the old system to all banks, where the biller's e-invoice address is changed to the company's own bank's e-invoice address. When the change messages have been sent to the banks, they can be transferred to Netvisor a few banking days after sending the change messages. NOTE! Change notifications made are transferred to Netvisor.

- If the billing notifications to be transferred have been sent with the allocation information “reference number”, the customers' receipt notifications will not automatically be allocated to the customer cards if the invoice history has not been transferred to Netvisor. In this case, the transferred receipt notifications must be manually allocated to the customer cards (Sales > Billing > Consumer e-invoicing > Link behind the Allocate receipt notifications)

- If the billing notifications to be transferred have been sent with the allocation information “reference number” and “customer number”, the customers' receipt notifications will automatically be allocated to the customer cards provided that the customer cards have the customer number corresponding to the receipt notifications.

- The account to which customers make payments must also be found in Netvisor. If an intermediary account has been used in the previous program, a Change message must be made in the old system before transferring the billing notification, where the bank account (to which customer payments arrive) is changed to the company's own account.

- The encoding of the material to be imported must be ISO-8859-1 to ensure that special characters are correctly formed in Netvisor.

Consumer e-invoicing transfer tool

First, the billing notifications valid in the banks must be transferred.

Once the billing notifications have been transferred, the customers' receipt notifications can be transferred.

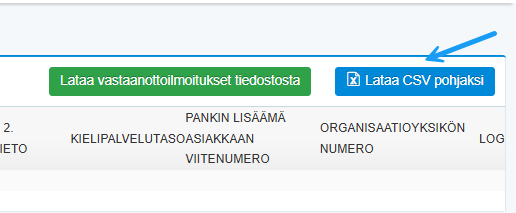

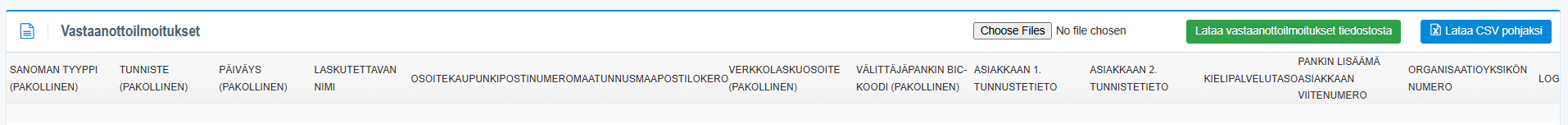

Receipt notifications can be transferred in XML or CSV format. The CSV template can be downloaded from the "Download CSV as template" button, and information can be directly filled in here if desired. The mandatory fields for importing receipt notifications are: Message type (Message ActionCode), Identifier (PaymentInstructionIdentifier. This can be found from the billing notification message in the paymentinstrucitionIdentifier field), SellerPartyIdentifier = business id, Date (ReceiverInfoTimeStamp), E-invoice address (InvoiceRecipientAddress) and Intermediary bank's BIC code (InvoiceRecipientIntermediatorAddress).

When you have selected the receipt notification file and pressed load receipt notifications from the file, they open in the preview view. If the material is not in the correct format based on the csv template, the load receipt notifications from the file button does nothing and it removes the selected file from the transfer. In this case, you should use the download csv template and enter the information through that template so that it can be transferred.

CSV file fields

MessageActionCode = Enter ADD here, as it is new additional information.

SellerPartyIdentifier = Enter the business id of the company to which the receipt notification is transferred. This is mandatory information.

PaymentInstructionIdentifier = Identifier field, which is mandatory. This is obtained from the billing notification's paymentinstructionIdentifier field. Here you need to check whether the information is the same for each bank or different per bank.

ReceiverInfoTimestamp = date field. Enter the information in the format day/month/year, e.g., 10/02/2026. This is mandatory information.

BuyerOrganizationName = Enter the name of the customer in the receipt notification

BuyerStreetName = customer's address

BuyerTown = Customer's address place of business

BuyerPostCodeIdentifier = Customer's postal code

CountryCode = Country code. E.g., FI

CountryName = Country name

BuyerPostOfficeBoxIdentifier =Customer's post office box address

InvoiceRecipientAddress = Bank account /consumer network address. This is mandatory information.

InvoiceRecipientIntermediatorAddress = Customer's bank account BIC/Swift code. This is mandatory information.

SellerInvoiceIdentifier1 = Allocation information 1. Enter either the customer number or reference number here. If you use the customer number, the receipt notification is allocated to the customer information where the number matches. If this is not found, the notification goes to unmatched and then it must be manually allocated to the desired customer if necessary.

- If the billing notifications to be transferred have been sent with the allocation information “reference number”, the customers' receipt notifications will not automatically be allocated to the customer cards if the invoice history has not been transferred to Netvisor. In this case, the transferred receipt notifications must be manually allocated to the customer cards (Sales > Billing > Consumer e-invoicing > Link behind the Allocate receipt notifications)

- If the billing notifications to be transferred have been sent with the allocation information “reference number” and “customer number”, the customers' receipt notifications will automatically be allocated to the customer cards provided that the customer cards have the customer number corresponding to the receipt notifications.

SellerInvoiceIdentifier2 = Allocation information 2. Enter either the customer number or reference number here. The logic works as mentioned above.

InvoiceRecipientLanguageCode = E.g., FI

BuyerServiceCode = This code is 00 or 01

00 = consumer e-invoice

01 = direct payment

If these details are not specifically provided to Excel, all transactions will go with the consumer e-invoice code.

EpiRemittanceIdentifier = Bank-added customer reference number. Not mandatory information.

BuyerOrganisationUnitNumber = Organization unit number. Not mandatory.

Only valid ADD messages need to be transferred from customers' receipt notifications. If these cannot be sorted from the current system, then all receipt notifications can be brought to Netvisor, and the latest notification by timestamp will remain valid.

Finally, ensure that the company's payment traffic agreement for sending consumer e-invoices is set to Netvisor's WS channel before sending consumer e-invoices from Netvisor. If the agreement is not in order in this regard, the sent consumer e-invoices will return in error.

Consumer e-invoice billing notifications

Sent billing notifications are visible in the "Consumer e-invoicing" view. If the sent billing notification has been successfully processed in the company's bank, the status of the billing notification is shown as Processed. If the processing remains in error at the bank, the status of the billing notification is then Erroneous. If the status shows: "Service agreement missing", this means that the company's payment traffic agreement for sending consumer e-invoices is not in order, or the billing notification has been sent with an incorrectly formatted sender's e-invoice address:

If you want to view the receipt or removal notifications received from billing customers for the billing notification by bank, as well as the history of sent billing notifications, you can access the view by clicking the timestamp in the Sending time column, which is a link.

There are three different types of billing notifications:

Billing notification

- The first notification to be sent, which activates consumer e-invoicing

Change notification

- With a change notification, you can change the information of a previously sent billing notification, such as the invoice subject, company name, or address information. This can be sent per bank by pressing the edit icon, then making the desired changes and continuing to the sending page, and from there the confirm edit button sends CHANGE

Removal notification

- With a removal notification, the billing notification corresponding to the selected invoice subject is removed from the bank to which the removal notification is sent

- In the bank, in addition to the billing notification, the receipt notifications made by customers for the respective invoice subject are removed

Editing and removing a billing notification

If an existing billing notification needs to be edited, it can be done by clicking the pencil-paper icon in the "Edit" column. Removing a billing notification is done by clicking the red cross in the "Remove" column. Edit/removal notifications are always made per bank, so a notification sent to one bank is only processed in that bank.

Processing receipt notifications

Customers' consumer e-invoice receipt notifications arrive electronically from the bank to Netvisor. The transmission time depends on the bank and is usually 1-3 banking days.

NOTE! For the receipt notification to match or be manually matched to the customer, the customer must be an individual customer. The customer card must have the option selected: Individual customer

Consumer customer's customer card cannot be manually saved with e-invoicing information.

For the electronically received receipt notification to automatically match the customer card in Netvisor, the following conditions must be met:

- If the matching criterion is the reference number, the customer must have been invoiced at least once from Netvisor. If the matching criterion is the customer number, the receipt notification automatically matches without the customer having been invoiced yet. The customer card must be created and active.

- The customer provides the identification information selected for the billing notification (some previous invoice reference number or customer number) on the receipt notification Note! It is recommended to provide a reference number from an invoice in Netvisor so that the customer's receipt notification automatically matches the correct customer and does not remain for manual matching

You can see the receipt notifications received from customers and automatically matched under the "Customers" column number link for each bank:

Manual matching of receipt notifications

If the receipt notification received from the customer does not automatically match the customer card, the receipt notification goes behind the "Unmatched receipt notifications" link in the Consumer e-invoicing view. Information about unmatched receipt notifications also appears on the Netvisor homepage under the "Exceptions and notices" heading.

You can manually match the received receipt notifications in the following way:

- Click the link "Unmatched receipt notifications"

- Click the pencil-paper icon on the right side of the view that opens:

- Enter the name of the customer to whom the receipt notification should be matched in the search field at the bottom of the view that opens and click the "Search" button:

- Match the receipt notification by clicking the Match link visible next to the customer:

Handling of incorrectly matched receipt notifications

If the automatic matching of the receipt notification has for some reason gone to the wrong customer or the e-invoicing information has been removed from the customer's information, the matching can be removed from the customer by clicking the red cross in the "Remove matching" column:

After this, the receipt notification moves behind the "Unmatched receipt notifications" link, from where it can be manually matched to the correct customer. The receipt notification can be removed through this view, but it should be noted that the removal is final.

Visibility of matched receipt notifications on the customer card

A successful match is visible on the customer card as follows:

- The customer card has a mention of the default billing method (Consumer e-invoice or direct payment)

- The customer card has the customer's e-invoice address and operator under the Consumer e-invoicing information heading

Sending consumer e-invoices

Consumer e-invoices are sent according to the normal sales invoice sending process. For invoices to be sent as consumer e-invoices (=e-Invoice), the sending channel is automatically set to E-invoice sending, and the material is sent electronically to the recipient's online bank. To successfully send invoices as e-invoices, the invoice (customer card) must have complete billing address information (street address, postal code, and postal address). The charge for sending a consumer e-invoice is the same as for sending a normal e-invoice. The routing time for consumer e-invoices sent through the bank network is 2-3 banking days from the sending date.

For a direct payment invoice, two materials are always created in the sending process: the direct payment material sent electronically to the bank, and the direct payment advance notice sent to the customer. Direct payment materials sent to the bank must always be sent first, and customer advance notices after this. In the sending process, there is a notification related to this: "Sales process has opened events that are dependent on each other. Process dependent events first (such as direct debit requests or factoring notifications)". The advance notice cannot be sent by email.

If the advance notice material is not desired to be created at all, the setting "Do not send direct debit advance notices" can be selected in the sales basic information (Sales > Settings > Basic data and settings). In this case, only the direct payment material sent electronically to the bank is created for direct payment invoices.

Attachments linked to e-Invoices do not transmit with the invoice material to the recipient's online bank. An attachment can be added to the direct payment advance notice either in the invoice sending process or directly to the invoice. In the sending process, only one attachment can be added, and the added attachment goes to all advance notices in the same sending process.

Consumer e-invoices returned in error

If an invoice sent as a consumer e-invoice is returned in error, the invoice can be found in the Open sales invoices view under the "Rejected" heading:

A notification of a consumer e-invoice returned in error is also visible on the Netvisor homepage under the "Exceptions and notices" heading:

The invoice information also shows the error message returned by the recipient's operator:

The most common error messages are "Recipient not found", "Recipient does not accept e-Invoices or direct payments" or "Service agreement missing". These error messages essentially mean that the customer no longer receives electronic invoices from the biller.

NOTE! Reminders for individual customers cannot be sent as e-invoices (consumer e-invoice), but these should be sent, for example, through a PDF printing service.

Canceling a consumer e-invoice

If a sent consumer e-invoice is incorrect or unjustified, you should contact the customer and inform them that the invoice is unjustified. A credit invoice cannot be sent as a consumer e-invoice from Netvisor, and it is not possible to send a cancellation invoice from Netvisor.

Canceling a direct debit invoice

Unfortunately, it is not possible to cancel a direct payment from Netvisor if it has been sent by mistake or sent multiple times inadvertently. In this case, you must contact the bank and ask if it can be canceled from their side.

Local printing

If the customer's payment method is direct payment, the invoice can be printed locally as follows: Go to the invoice and press "Send invoice". The invoice moves to the sending view. From this view, check direct payment and then press "Remove selected from process". Another material remains visible. Select it and press "Change selected channel" and choose "Local printing". Then press "Select". Finally, you can print the invoice.

Customer changes bank

If the bank of the customer being invoiced changes, they must first remove the consumer e-invoice receipt in the old bank and then make a new receipt agreement in the new bank. The information does not automatically transfer to the new bank.

When the company's bank changes

If the company changes banks and sends consumer e-invoices to its customers, a change notification for the billing notification must be made when both the old and new bank account and payment traffic agreement are valid. If the old agreement is no longer valid, the change message cannot be sent, and billing notifications with incorrect information remain in the banks.

First, add the new bank's bank account to Netvisor and place a check mark in the bank account information in the section "Account available on invoice forms" so that the sender's e-invoice address is formed for the billing notifications to be sent. After this, the bank account in question is added to the Invoicing addresses page as a new e-invoice address. When adding e-invoice address information, select the correct format for the e-invoice address IBAN/OVT (this information can be found on the payment traffic agreement).

Note: If the company has a Danskebank account, the consumer e-invoice agreement must be made to an IBAN-formatted address for Danskebank.

Once these are done, from Sales > Billing > Consumer e-invoicing, click the Edit button (pencil and notebook icon) for the bank and select the new e-invoice address from the drop-down menu. For the biller's bank contact information, vselect the company's bank accounts to which customer payments are desired to be made. After the selections, continue to the sending page, check the Change message information, and send the request forward to the bank. This must be done individually for each bank to which the change is to be notified.

Consumer e-invoicing with auxiliary business names.

If invoices from different auxiliary business names are sent with the same invoice subject, one billing notification is sufficient for all banks, and the bank accounts of all auxiliary business names for which payments are desired are selected as payment accounts for this billing notification. Then, in the information of each auxiliary business name, the desired bank account is selected. This way, only the desired bank account is set as the payment account for each auxiliary business name's invoice.

If each auxiliary business name has its own invoice subjects, then a separate billing notification must be sent for each invoice subject. In other words, one billing notification per invoice subject.

In the E-invoice address (target bank) section, select the bank account where the company has a payment traffic agreement for sending consumer e-invoices.

Consumer e-invoicing, if it has remained active in the old system

We always recommend stopping consumer e-invoicing from the old program before it is activated in the new program.

However, if this has remained active in the old program and a new billing notification has now been made in Netvisor and through it a new consumer e-invoicing agreement with the desired invoice subject text. If this has been done in a different bank in the old system, you must still contact the old bank and request to temporarily activate the consumer e-invoicing agreement if it is not currently active. Then, a removal message must be sent from the old system for this and wait until it is processed, and then stop the consumer e-invoicing agreement. The removal message only removes the consumer e-invoicing from the old system and does not affect the agreement made through another system in the future.

Keywords: Consumer e-invoicing, billing notification, e-invoice address, receipt notification, electronic invoicing

Did you find it helpful? Yes No

Send feedback