Paying holidays in Netvisor is a process where accrued annual holidays and holiday bonuses are paid to the employee in conjunction with the payslip. This guide covers the payment of holiday pays and holiday bonuses, management of warnings, and special situations in holiday calculation presented in passive voice as a summary.

CONTENT

- Check selected payroll bases

- Paying holidays of the current holiday year

- Warning: Salary in money formula missing the following salary types (No holiday calculation method)

- Warning: Salary in money formula missing the following salary types

- Warning: Holiday calculation method formula does not form a daily price

- Checking the holiday calculation method formula

- Rounding holiday days

- Municipal holiday calculation: time period-based and calendar information formula elements and leap year

- Frequently asked questions

Before paying holidays, check the employee's holiday accrual status from the Holiday pay debt view.

Payroll > Holidays > Holiday management > Holiday pay debt

Check selected payroll bases

Netvisor's holiday calculation allows holiday days to be paid in three different ways:

- Use approved time entries of the annual holiday type recorded in Netvisor's working hours, which automatically rise for payment.

- Manually enter annual holiday-type entries in the "Check selected payroll bases" phase in the "Approved time management information" section.

- If working hours recording is not used, manually add values in the payroll process during the "Check selected payroll bases" phase before creating the payslip to the "Taken holidays", "Payable holidays", and "Payable holiday bonus days" fields.

Taken holidays

- Note that taken holidays by default bring in the approved holiday days of the pay period.

- If the information is already in the working hours entries, it cannot be edited directly in the column, but correct the holiday days in the working hours entries to ensure consistency between the payslip and the working hours view.

- If there is nothing to fetch from the working hours entries, manually enter the taken days into the field.

Payable holidays

- Payable holidays are offered as the difference between taken and paid holiday information on the payslip. The value formed in the column may therefore differ from the value in the "Taken holidays" column.

- Note that unpaid holidays from different holiday years are interpreted according to the Holiday pay debt list, with all paid holidays considered used from oldest to newest.

Payable holiday bonus days

- Note that payable holiday bonus days are offered as the difference between taken and paid holiday information on the payslip.

- Define payable holiday bonus days separately according to the company's practices.

- Select "Arrow" "Setting payable holiday bonus days".

- Pay holiday bonus days up to the number of unpaid holiday bonus days of the employee. If you set a larger number to be paid, the employee will be paid according to the days accrued.

Edit the default setting for paying holiday bonus days from the salary model settings:

Payroll > Payroll > Salary model management > Select salary model > Holiday settings tab

Choose from two options:

- Suggest paying holiday bonus days according to used holiday days

- Do not suggest paying holiday bonus days

Paying holidays of the current holiday year

If so many holiday days are added for payment on the payslip that they consume the accruals of the current new holiday year, note that the earnings in payment on the payslip (e.g., monthly salary) do not affect the calculation of the holiday day's price. In these situations, check and manually edit the holiday day's price on the payslip. The holiday day's price can only include paid payslips and earnings entered in the payroll history.

Warning: Salary in money formula missing the following salary types (No holiday calculation method)

If the employee does not have a holiday calculation method in use, the program warns: "Salary in money formula missing the following holiday pay salary types: "Holiday pay (No holiday calculation method), Holiday bonus (No holiday calculation method)".

Enable holiday calculation for all employees from the settings:

Payroll > Settings > Holiday calculation settings

User guide: Implementing holiday calculation

The warning does not prevent payroll processing, but it disappears only when a holiday calculation method is selected for the employee and the necessary salary types for paying holiday pay are linked to the Salary in money formula of the salary model.

Warning: Salary in money formula missing the following salary types

If the salary types of the holiday calculation method are missing from the Salary in money of the salary model, the program warns: "Salary in money formula missing the following holiday pay salary types: Holiday pay (Monthly salaried), Holiday bonus (Monthly salaried)".

Check and edit the Salary in money formula from:

Payroll > Payroll > Salary model management > Select from the salary model > Formulas > Salary type formulas tab > Calculatory > Salary in money > Edit (pen/notepad)

Add the missing salary types from the green plus:

- Calculation: + and salary type: Holiday pay (Monthly salaried)

- Calculation: + and salary type: Holiday bonus (Monthly salaried)

- Calculation: + and salary type: Holiday compensation from holiday pay (Monthly salaried)

- Calculation: + and salary type: Holiday compensation from holiday bonus (Monthly salaried)

Warning: Holiday calculation method formula does not form a daily price

If the formula does not calculate a value for the holiday day's price, a warning is given: "Holiday calculation method formula does not form a daily price".

- Open the payslip from the "Edit" link.

- Check the warning triangles on the holiday pay rows.

- Edit the salary type row from the "pen/notepad" icon and save values in the columns to remove the warning.

Checking the holiday calculation method formula

Check the formula from the payslip's "Payroll accountant view" tab by hovering the mouse over the salary type name.

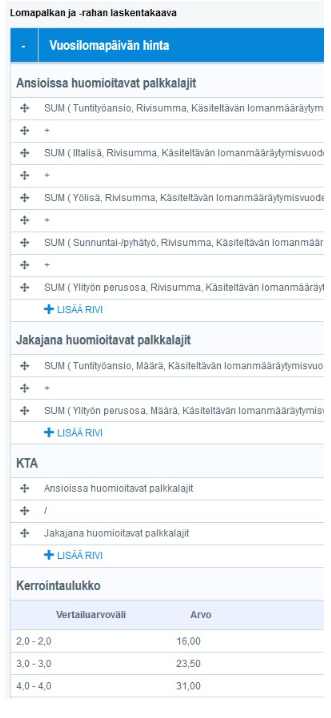

If LomaKTA or LomaKPA calculation is in use, click the "gray arrow" to check the salary types considered in earnings and divisors.

The formula can also be seen from: Payroll > Settings > Holiday calculation settings > Holiday calculation methods > Select holiday calculation method > Holiday price

Rounding holiday days

Note that paying holidays on the payslip and the Final account function bring all unpaid holiday days for payment. If there are decimals in the balances, they rise for payment as they are. The Final account function only rounds the unpaid accruals of the current holiday year to whole days.

Manually rounding holiday days

- Manually round holiday balances from holiday reports.

- Mark additions to holiday accrual in the Holiday pay debt view.

- Correct possible half days to whole days to ensure no decimals remain in holiday reports and formulas.

Coefficient table and rounding

When holidays are paid on the payslip, the number of holiday days is not rounded, but the coefficient table can round half days upwards, even though the coefficient table's range is expressed, for example, as 6.0-6.0, rounding occurs according to mathematical rules. So if in KTA calculation the holiday accrual from some year is 6.5 days, then the coefficient table value corresponding to 7 days is used in the calculation of the holiday day's price, but 6.5 days are used as the divisor in the formula.

Municipal holiday calculation: time period-based and calendar information formula elements and leap year

If you use a holiday calculation method with time period-based elements, such as "Calendar days in the pay period" or "Weekdays in the pay period," values are fetched from the next year.

April - December

If a pay period is created from 1.7.2023 - 31.7.2023 and annual holidays from 1.4.2020 - 31.3.2021 are paid, the divisor for the formula is fetched from the previous year's corresponding time period's working days, meaning the working days from 1.7.2020 - 31.7.2020 are used as the divisor for the holiday day.

January - March

If a pay period is created from 1.2.2024 - 29.2.2024, where annual holidays from 1.4.2020 - 31.3.2021 are paid, the divisor for the formula is fetched from the previous year's corresponding time period's working days, meaning from 1.2.2020 - 29.2.2020 (=leap year). Thus, for the holiday year 1.4.2020 - 31.3.2021, calendar information from 2/2020 would be fetched, which does not belong to the holiday year 2020-2021, but to the holiday year 2019-2020. Thus, the divisor becomes 29 days, as 2020 was also a leap year, even though the only February included in the holiday year 2020-2021 was February 2021.

Frequently asked questions

Can the breakdown of holiday years be removed from the salary type row on the payslip?

Yes. Edit the salary type row from the "pen/notepad" icon, as long as the payslip is still unpaid and undelivered. Clear the "Specification" field for each employee. Note that there is no mass function for removing the information.

Keywords: holiday pay, holiday bonus, holiday calculation, holiday year, daily price, salary in money, rounding, municipal holiday calculation, leap year.

Did you find it helpful? Yes No

Send feedback