This guide covers the types of tax cards, adding a new tax card, and automatically retrieving withholding tax information. Additionally, it provides instructions on handling tax cards at the turn of the year, monitoring income limits, increasing the tax rate, and managing change and tax-at-source cards.

CONTENTS

- Types of tax card

- Adding a new tax card

- Automatic retrieval of withholding tax information

- Considerations for manually saved tax card at year-end

- Increasing the tax rate

- Change tax card

- Retrieving tax card for selected payment date

- Tax-at-source card

- Additional tax rate on tax card

- Frequently asked questions

- How to check if the income limit of the tax card has been exceeded?

- How can an employee monitor the income limit of their tax card?

- Which earnings affect the calculation of the tax card income limit?

- I have updated a new tax card for the employee, but the withholding tax on the payslip is still calculated with the old tax card or additional tax rate?

Types of tax card

There are six different types of tax cards:

- Tax card for salary

- Tax-at-source card

- Nonresident's tax card

- Tax card for seafarer’s income

- Non-wage compensation for work (subject to VAT)

- Non-wage compensation for work (not subject to VAT)

Adding a new tax card

You can open the view by selecting Pay > Personnel > Employee listing > click on the employee's name > Tax cards tab.

Add a new tax card as follows:

- Select the "New tax card" button.

- Enter the start date and end date of the tax card.

- Select the type of tax card.

- Enter the basic and additional tax rates and the annual income limit.

- Provide clarifications if necessary, if the employee is an "Key person" or "Person living in a border municipality".

- Optionally, write an internal comment (optional field).

- Save the information.

Automatic retrieval of withholding tax information

With the retrieval of withholding tax information, you can request the current tax card information of employees directly from the tax authority via the interface. This avoids the delivery of tax cards to payroll and their manual entry. You can use the retrieval throughout the year for both basic tax cards and change tax cards.

See detailed instructions: Retrieval of withholding tax information

Considerations for manually saved tax card at year-end

If you save the tax card manually, note that they are only valid for the time recorded in the tax card information. If a manually saved tax card ends at the turn of the year and no new tax card is added or retrieved for January, taxation in January will be carried out according to a 60% withholding tax.

Increasing the tax rate

If an employee wants to increase the basic percentage of the tax card without providing a new change tax card, change the basic percentage directly on the existing tax card. Write information about the percentage increase at the employee's request in the comment field of the tax card.

Change tax card

A new tax card that comes into effect during the year is saved by selecting "New tax card" according to the validity dates of the tax card, and the previous tax card is ended before the start date of the new tax card. The newly saved tax card considers earnings only from the effective date onwards. The program can automatically end the previous tax card to the previous date.

Example: The employee has an original tax card valid from 1.2.2019 - 31.1.2020. The new tax card is valid from 1.10.2019 onwards. The old tax card is ended from 1.2.2019 - 30.9.2019, and the new tax card starts from 1.10.2019 - 31.1.2020.

Retrieving tax card for selected payment date

Community update: Retrieving tax cards effective from 1.2.2023

Pay > Employee listing > Tax cards

You can retrieve tax cards for the selected payment date in the retrieval of withholding tax information:

- First, select the employees.

- Select the "Retrieve tax cards" button that appears in the lower right corner of the view.

- Retrieve tax cards from the window that opens using the date search.

Note that the retrieval of tax cards only applies to tax cards for salary. Tax-at-source, Tax card for seafarer’s income, and Nonresident's tax cards must still be delivered to payroll and manually saved in Netvisor.

Tax-at-source card

When you select the type of tax card as "Tax-at-source card", the view changes so that you can provide the necessary information for the tax-at-source card:

- Tax at source deduction per month

- Tax at source deduction per day

If the employee has a tax-at-source card, the program automatically directs the withholding tax on their payslip to tax at source on a separate report. On the payroll report, the withholding tax is automatically reported with income type 404, even if the withholding tax salary type originally had income type 402. More information: Weekly update 1.2.2019 - release note.

Additional tax rate on tax card

On the payslip, withholding tax is automatically deducted from the pay at the additional tax rate if the employee's income limit is exceeded. You can apply the additional tax rate to part of the pay or the entire pay.

Frequently asked questions

How to check if the income limit of the tax card has been exceeded?

In Netvisor, the income limit of the tax card is affected by all salaries calculated in Netvisor, whose salary payment date falls within the validity period of the tax card.

You can search for salaries paid to the employee by salary payment date and limit the search by the validity period of the tax card on the payroll reports.

Pay > Reports > Payroll reports

Check the information also on the employee's payslip:

- You can see cumulative earnings from the beginning of the year (from 1.1.20xx onwards).

- You can see the income limit of the tax card.

- If the income limit is exceeded, the program automatically calculates the additional tax rate on the payslip.

Note that the income limit of the tax card is also affected by earnings entered in salary history information and earnings added to the tax card information as "Earnings affecting the income limit".

How can an employee monitor the income limit of their tax card?

The employee can see the income limit of the tax card and earnings from the beginning of the year in the payslip information.

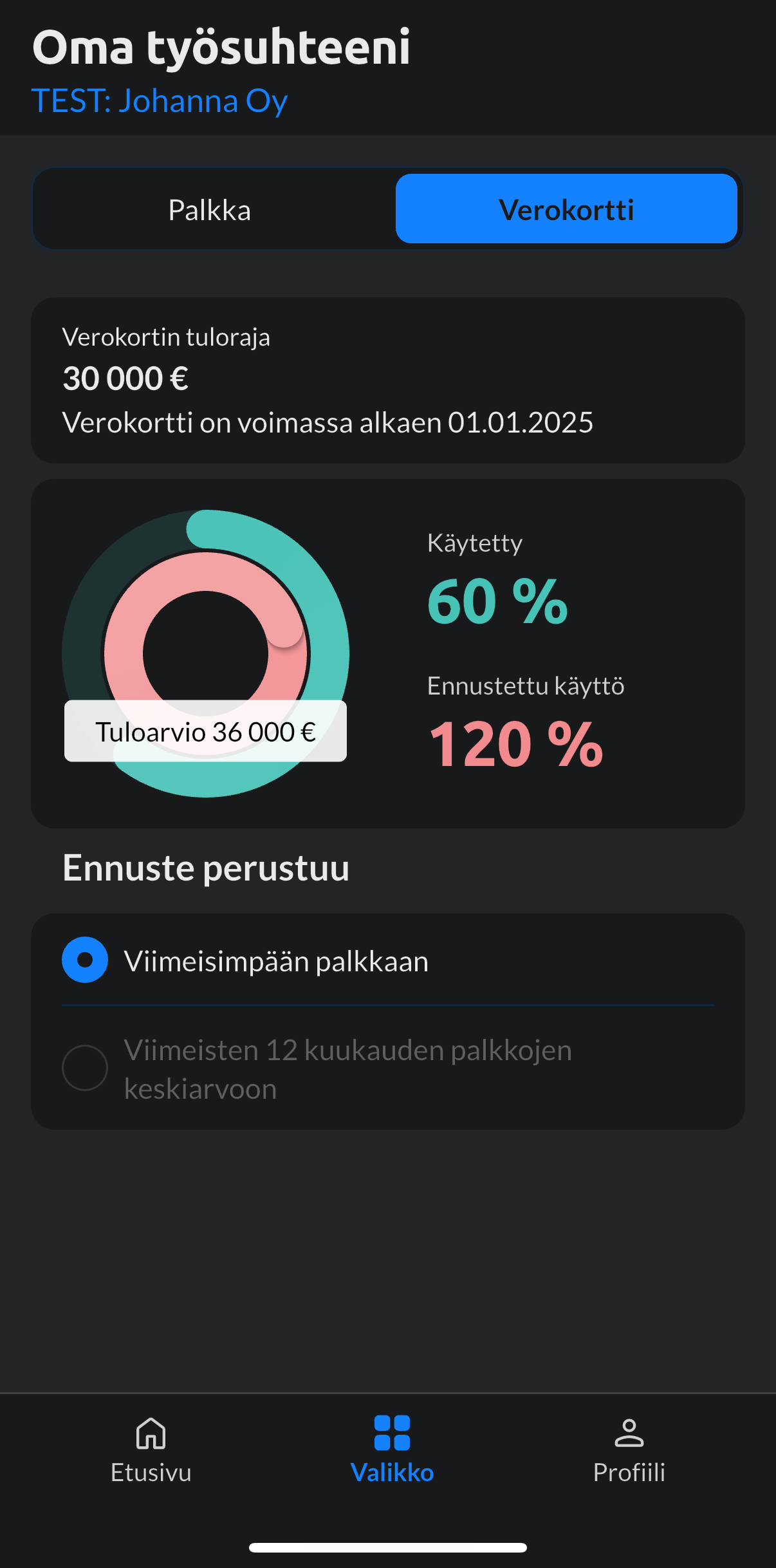

The employee can also monitor the income limit of the tax card in the Netvisor mobile application in the "My employment" section, where the "Tax card income limit" and forecast of annual income are displayed. The forecast can be chosen to be based either on the latest salary or the average of the last 12 months' salaries.

In the Netvisor mobile application, the employee can see already earned income by pressing the green section of the pie chart. After this, the earned amount will appear on the view.

The forecast of annual income can be seen by pressing the red section of the pie chart. After this, the annual income estimate will appear on the view.

Which earnings affect the calculation of the tax card income limit?

The income limit of the tax card is affected by all salary payment dates on payslips that fall within the validity period of the tax card. For example, if salary has been paid with an old tax card, but its salary payment date falls within the validity period of the new tax card, this payslip is considered in the calculation of the new tax card's income limit.

I have updated a new tax card for the employee, but the withholding tax on the payslip is still calculated with the old tax card or additional tax rate?

We always recommend that the employee's information and tax card information are saved and updated before creating the payslip. If the payslip has already been created and you update a new tax card only after that, proceed as follows:

- Update the payslip information or recreate the entire payslip.

- This ensures that the calculation of withholding tax is updated according to the currently valid tax card.

Keywords: Tax card, withholding tax, tax at source, change tax card, income limit, tax rate, tax card retrieval

Did you find it helpful? Yes No

Send feedback